Upload a Voided Check but Dont Have Checks

Direct deposit is a useful payroll feature that lets you get your paycheck deposited straight into your checking account.

Instead of getting a physical check each payday, the money shows up in your account the morning time that your paycheck is due. This saves you the hassle of having to visit the bank to cash your paycheck multiple times a month.

Often, when you endeavor to prepare upward direct eolith, your employer will ask for a voided bank check. They apply the cheque when setting up your direct eolith.

Larn why your employer requests a voided check and find out what alternatives you tin provide to your payroll department.

Why Do Employers Ask for a Voided Check?

Employers ask for a voided check when setting up your direct deposit because it provides all the data necessary to deposit coin in your checking account.

All U.S. banks have routing numbers and all deposit accounts have account numbers attached to them.

Routing numbers are used to place financial institutions and have been in apply for a century. A routing number indicates a specific financial institution, as well as the geographic region of the state it is located in. No ii dissimilar banks can take the same routing number.

Account numbers identify specific accounts at a fiscal institution. No ii accounts at the same depository financial institution will take the same account number.

Information technology is possible for different banks to assign the same account number to dissimilar accounts. Because the banks accept different routing numbers, your payroll department won't accept trouble sending your paycheck to the right place.

Getting the numbers right

Your employer tin can identify your specific depository financial institution account using but the routing number and account number you provide.

The payroll system will utilize the depository financial institution'south routing number to straight your paycheck to the proper bank. It will provide your account number so the banking concern can deposit the money into your account.

In theory, yous should be able to just provide a routing number and account number to your payroll department. The voided check isn't necessary, information technology just happens to have both numbers printed on it.

Then long equally they re-create that information properly, they'll be able to make the eolith. Notwithstanding, many companies require that you provide a voided check.

Your company volition place the voided check in your file so that information technology can be referenced in the time to come if necessary.

For instance, if your company changes payroll processors, information technology may need to provide everyone's routing and account numbers to the new processor.

Having the voided bank check on-hand also reduces the likelihood of payroll using the wrong data when information technology sends out paychecks since they have the check on-manus to reference.

Paychecks deposited into someone else's account

It's very important that the payroll department transport your paycheck to the proper place. If information technology winds up in the wrong account, it can be a huge headache to get the coin back.

If this happens, the get-go affair to do is to notify your payroll department. You'll have to evidence that the money never arrived.

Usually, you can just provide a statement that shows the lack of a deposit. So, your payroll department volition demand to rail where the money was sent.

Then, it will contact the bank that received the erroneous eolith and request that the coin be returned. Finally, once the money is returned, your company will send it to you.

This process can have weeks or even months. That's why many employers are strict about requiring a voided cheque.

If you lot practise not want to provide a voided cheque, you can ask your employer for alternate ways to confirm a bank business relationship. You could also ask your employer to make an exception for you if you have specific reasons for non providing the cheque.

How Can I Get a Voided Cheque?

Your employer asks you to provide a voided check so that the cheque cannot be used should it fall into the wrong hands.

If someone gets your checkbook, they may attempt to write checks against your business relationship. Information technology's possible that they would succeed, causing coin to be removed from your business relationship without your consent.

Voided checks are exactly that: void. They cannot be used for transactions, merely like a check that is ripped up becomes worthless.

You tin can go a voided check in a few unlike means.

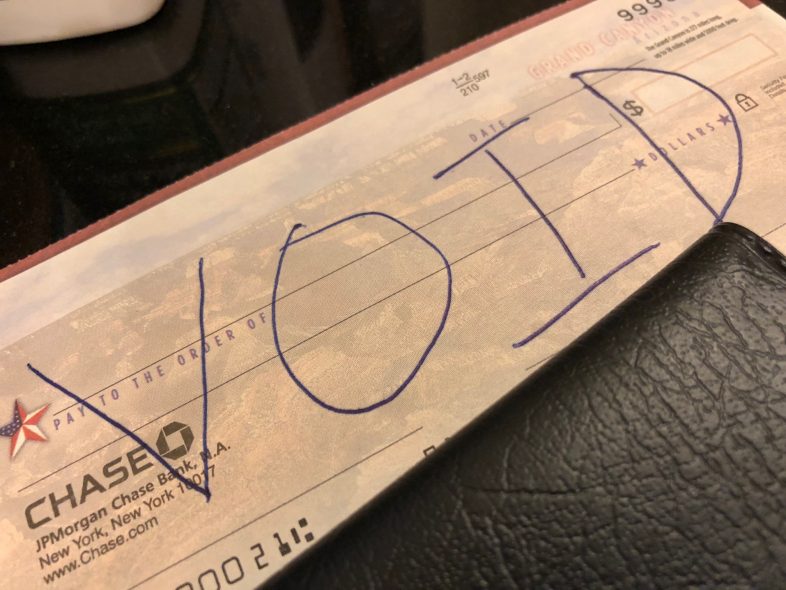

The easiest is to remove a check from your checkbook and to void information technology. Use a permanent, black or blue pen to write VOID in large letters on the check. Ideally, write it in multiple places, such as:

- The payee line

- The payment amount line

- The payment amount box

- The signature line on the dorsum of the check

- Alternatively, write 1 big "VOID" that covers the whole face of the bank check

By clearly writing "VOID" on the check in multiple places, you brand information technology impossible for someone else to use. You can then provide the check to your employer so they tin ready direct deposit.

If you don't take a checkbook, or don't want to void ane of your checks, contact your bank. A teller may be able to impress a pre-voided cheque that you can use to confirm your account. Most banks that operate physical branches will exist happy to do this for you.

Setting Upwards Directly Deposit Without a Voided Cheque

If for whatsoever reason, you lot cannot or do not want to provide a voided bank check, you nonetheless have options.

Direct deposit forms

Many banks, even if they don't provide pre-voided checks, offer direct deposit forms. These forms are like pre-filled directly deposit forms that yous can provide to your employer. They should suffice as proof of your checking business relationship for your company.

Bank documentation

Some other selection is to enquire a teller at your bank for documentation that provides the same data as a voided check. A letter on bank letterhead with your business relationship information could piece of work. All you really need to provide is your account number and the bank's routing information.

Your account statements

In a compression, yous might be able to provide a copy of a recent account argument. It will include your business relationship number and the name of your depository financial institution. Yous tin provide the routing number to your employer who tin check it to ostend that it matches the proper noun of the bank on the argument.

It's worth taking the necessary steps to set up directly deposit because it can save y'all a lot of time. Another do good is that many banks accuse maintenance fees that can be waived if y'all set up direct deposit. Setting it upwardly can mean you lot save a few dollars every month by avoiding bank fees.

Splitting Your Direct Deposit

If you desire to go fancy with your money direction, or merely automate it farther, you can carve up your direct deposits. That means that you can have a portion of your paycheck sent to dissimilar accounts.

For example, say that your usual paycheck is for $1,200, merely you only spend $1,000 per pay period. Y'all tin can fix your direct deposit to put $1,000 of your bank check into your checking business relationship.

Then, y'all can transport the remaining $200 to your savings account. You don't have to recall about the extra coin or manually move it to the account.

It merely automatically arrives in your savings business relationship and starts earning interest. (We always recommend an online savings account with high interest rates and depression fees.)

This makes managing your finances much easier and helps remove the temptation to spend your actress cash. You tin can use this characteristic to prepare a savings plan.

If you want to salvage $100 a month to have a vacation, set upwards a new account for holiday savings. So set direct deposit to put $100 per month into the business relationship. At the end of the yr, y'all'll take the $1,200 you need for your trip.

About payroll systems let you split your paycheck multiple ways, so you tin have money going to three, four, or fifty-fifty more accounts. That means you can use your direct deposit to automate your savings towards multiple goals at in one case.

Many banks, specially online banks, make it easy to open up multiple savings accounts. Each come with their own account numbers.

Yous tin also requite each account a proper name similar "emergency fund," "car fund," or "vacation savings." Splitting your paycheck among multiple accounts, each with its own goal makes it easy to save.

Combine that feature with savings plans like 401(thou)due south that come correct out of your paycheck, and you can automate virtually all of your required savings. Making sure you don't overspend and go out nothing left in your account has never been easier.

Conclusion

Direct deposit is incredibly convenient, once you have it ready. Y'all won't accept to worry about losing a bank check or wasting time cashing it or depositing it. Instead, just go about your life as money constantly arrives in your checking business relationship.

To make things even better, direct deposit doubles as a dandy way to automate savings. Set upward automated deposits from your paycheck to savings accounts.

Your savings volition exist separate from your spending cash then you won't be tempted to spend it, and the balances will grow with each paycheck.

Though it may take some effort, the benefits of setting upwards direct deposit make information technology worth doing.

Source: https://www.mybanktracker.com/checking/faq/set-up-direct-deposit-without-voided-check-272890

0 Response to "Upload a Voided Check but Dont Have Checks"

Postar um comentário